Despite their simplicity, Savings Groups are surprisingly complex structures, that not only move money around in interesting ways, but have a strong social side. They bring out the best in their members, except that sometimes they go through stormy periods when members have to work out their disagreements. They are generally safe places to save, except when they aren't. They often continue to function for years, but sometimes go through curious transformations. Savings Revolution had hundreds of blog posts about SGs from generous writers who went deeply into various subjects. Here are some that we recommend.

Paul Rippey asks, Why do we think that everyone needs to invest in Income Generating Activities? And, where did we get the idea that all these activities actually generate income?

How can I have consistently excellent groups? Paul Rippey says it's easy: First, you need to be deeply dissatisfied when you realize you don't have consistently excellent groups.

Do you wonder if people are just a tiny bit, uh, irrationally exuberant about mobile money? Ignacio Mas puts forward some reasons why this might be so.

Kim Wilson suggests that Universities have their own agendas which can get in the way of objective research. LOTS of comments on this one.

Paul Rippey

If everybody is selling debt, somebody has to blow their horn for savings...

Paul Rippey

Savings Groups are a good place for members to save and borrow. We don't need to make up fabulous "returns on investment" to sell them.

Kim Wilson

There goes Kim again, trusting the adults in Savings Groups to make good decisions. It's a radical thought, but we're a revolutionary website...

Paul Rippey

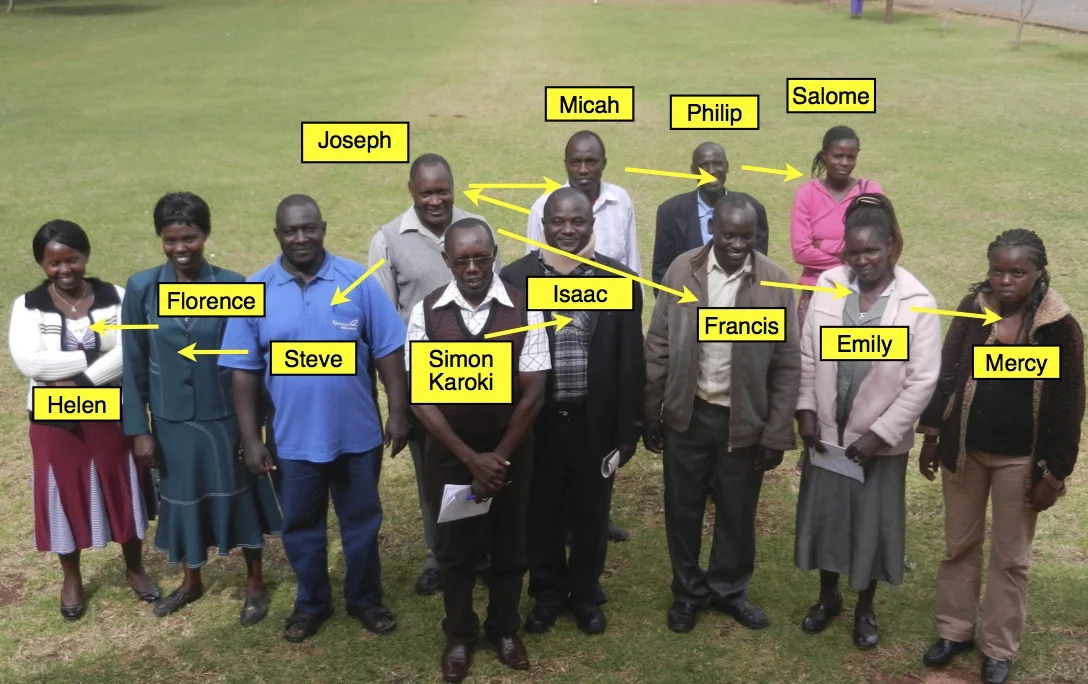

In Western Kenya, CRS has done a remarkable job of passing along competence and information to new generations of trainers.

Girija Srinivasan

A plea for responsible finance in the largest village based financial movement in the world. SG practitioners should look at the SHG experience to help alert us to possible pitfalls.

Ignacio Mas

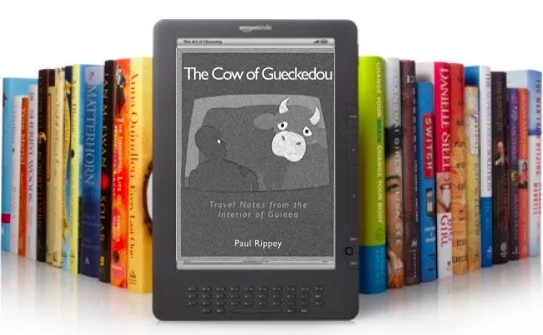

eBooks are great - really wonderful. But they aren't what everyone wants all the time. Same goes for digital financial services...

Paul Rippey

Two words you need to know before you get into micro-insurance: "Loss Ratio"...

Paul Rippey

What is the ONE KEY FACTOR in a good SG program? You'll find out here.

Various contributors

...here in the city, people can run away, and they don’t answer to anyone, and no one will stop them. How are you going to make sure that anyone who borrows repays?”

Kim Wilson

"Today, I used my smart phone to pound tiny nails into a wall. The procedure worked well enough to hang a small picture, but it cracked my phone case..."

“How would you like it if your bank made you sit with a group of neighbors in order to carry out your banking business?”

While even a negative experience with microcredit can benefit savings groups, the same isn’t true of a history of handouts

Many of you are familiar with India’s self-help groups, also called SHGs.

From 2002-2004 while living in Calcutta, I had the chance to be directly involved with an amazing project.

Each of us that evening struggled to explain the difference between credit-led groups and savings-led groups to newcomers.

This week I went out to the Nicaraguan highlands, two hours from the nearest significant urban area, and met up with one fantastic savings group:

The movies do an excellent job of explaining the basic concepts in just 8 and 5 minutes shorts

In the early days of the microcredit revolution it was often said that the rigid, short-term solidarity loan products of the day were ‘low-hanging fruit’.

One of the debates that we haven’t had much is what should happen to Savings Groups after they have been trained.

While Nicaraguan credit regulations dictate that children should not be allowed to take out loans, there are no rules stating that they can’t lend money.