Protecting Savings Groups and their members

Savings Groups are generally successful: members save money together and follow the rules well enough that the group can have as long a life as the members wish. However, sometimes they are so successful that the savings becomes a threat: all sorts of thieves, swindlers, usurpers, corrupt elites, and quick-profit money-men appear, trying to separate poor people from their money. Sadly, sometimes they succeed. As the American folksinger Woody Guthrie said, As through this world I've rambled, I've seen lots of funny men. Some rob you with a six-gun and others with a fountain pen. He could have been singing that to savings group members.

The challenge is complex, and so are some of the solutions discussed here. One straightforward place to start is the SEEP Program Quality Guidelines for Savings Groups. They have some good advice in them, and links to other resources should you want them. And, read below.

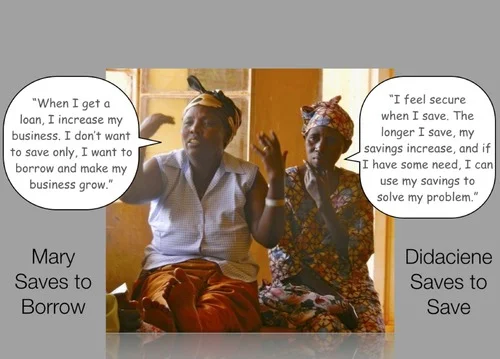

Kudos and Lessons from One Movement to Another is Larry Reed's excellent advice to SG practitioners: we shouldn't believe our own propaganda, we shouldn't get caught in a race for extraordinary numbers of members, and we should remember that it's not the money that keeps us going. Outside the Categories of the Marketplace deepens the conversation about money - from someone even better known than Larry Reed: the Pope. Look Ma - No Hands! speaks to the desire to complicate SGs with new features. They don't need new features, let us just master making them work the way the are. Should we all be Mary? and Why I don't share in the enthusiasm for Financial Inclusion both look at the question of what financial services do poor people really need.

Finally, since the most important way to protect members - and we know that not all members are sufficiently well trained - look at the post on Critical Message Videos. How can you use media to make allyour groups stronger?