What we need to ask about micro-insurance

Micro-insurance is hot, as NGOs and multilaterals work with insurance companies to encourage people, including savings group members, to buy insurance policies for health, agricultural production and other things. Absent from most of the discussion is any mention of pay-out or loss ratios. It’s good to understand these things.

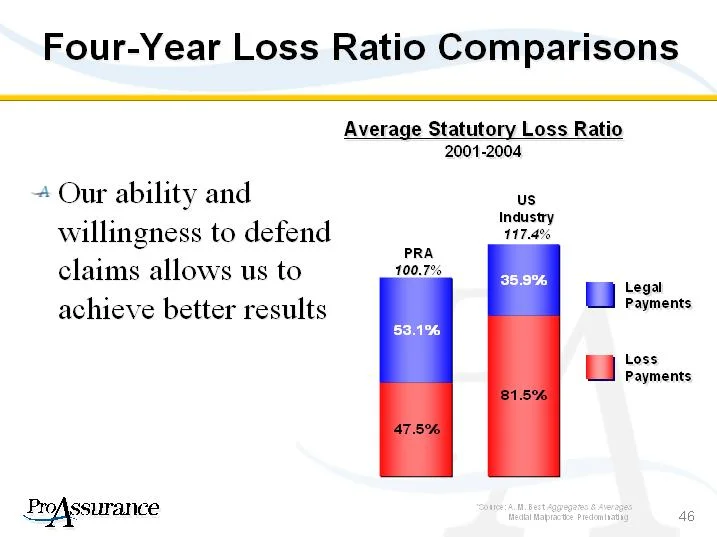

Insurance companies, we all understand, issue insurance policies, and collect premiums from their clients. When certain conditions arise, then the companies pay out claims - give money to - the clients. Have you ever wondered on average how much insurance companies take in, compared to how much they pay out? We call the amount paid out in claims, divided by the amount paid in by the clients in premiums, the pay-out ratio. (By the way, for the insurance companies, any money paid out is an expense, and so they refer to the money paid out divided by the money coming in as their loss ratio. This reflects the simple fact that it is not in the insurance company’s interest to pay claims. Click on the little chart to get a glimpse inside the collective mind of the insurance industry.)

What is a typical pay-out ratio? The Affordable Healthcare Act in the US, often called “Obamacare”, requires health insurance companies to pay out at least 80% of their premiums in claims. That is, it requires that the pay-out ratio be 80% or higher.

However, in a profitable sustainable micro-insurance scheme, the pay-out ratio is likely to be much lower, because typical premiums are small, and administrative costs are high because of many small transactions. How much lower? An insurance friend once told me that it would typically be less than 50%. That is, a group of micro-insurance clients paying money into the company would be unlikely to get more than half their money back.

Is that worth it? It depends: pooling risk is important because it keeps catastrophes from putting people out of business, from losing everything. And, if they are insured, entrepreneurs will sometimes take risks that they wouldn’t take in the absence of insurance. If micro-insurance can cause all this, then the social benefit can be huge. The pay-out ratio is only one thing to look at in evaluating a micro-insurance scheme.

However, the pay-out ratio is still important. Would we recommend insurance if the pay-out ratio is only 50%? How about 25%? 10%?

My point is simply that the pay-out ratio is an important factor to keep in mind, and I note that it is almost completely absent from the discussions of micro-insurance that I see on various blogs and other fora. We need to talk about it, but the insurance companies are unlikely to bring it up. It’s our job to ask the question.

If you are thinking of getting involved, or getting savings groups involved, with micro-insurance, don’t forget to ask the provider, “What is your projected pay-out ratio?” or, if you want to speak their language, ask “What is your projected loss ratio?” They have already thought about this, and their actuaries have made projections. It’s a fair question to ask.

PS. I’ll be grateful if readers share this with any micro-insurance folks, and if people read this that know microinsurance well, please correct any errors.

Reader Comments (3)

Paul at MicroEnsure we target a loss ratio of between 45% to 70%. If the loss ratio is less than 45% then the product is poor value to clients but if it is more than 70% then it is unlikley to be sustainable for the insurer due to admin and distribution costs.

You are totally right that this should be a key question to ask and I would encourage people to ask it. I also wish that people would ask the same question of people that promote savings and credit as to what the true cost of the product is. I am surprised at how high MFI's interest rates remain or how low the interest rate offered on savings is. The issue for anyone doing microfinance whether that be credit, savings or insurance is the relativly high cost of admin and distribution as a percentage of the revenue generated from the small value loaned, saved or insured.

Fri, April 26, 2013 | Richard Leftley

Thanks Richard. It's good to hear from you and it's good to hear that MicroEnsure is committed to transparency and to providing good value for its clients. Readers, check out http://www.microensure.com.

I hope it is clear about how much I agree with you both about the importance of transparency in micro finance, and about its remarkable absence. Anyone wanting to increase transparency about the cost of credit should go quickly to www.mftransparency.org. A post is coming soon here about the inflated percentages claimed by savings groups. I fear we are suffering from some of the same boosterism as microcredit - though, I will argue, the error of us SG promotors is not as egregious as that of micro-credit.

Fri, April 26, 2013 | Paul Rippey

While there are examples of insurance products with extremely low loss ratios being offered to poor households there are equal number of examples of products with loss ratios higher than 100% in some markets and for some class of insurance products. Maintaining loss ratios at an 'acceptable' level so that the product retains good client value on one hand and also makes financial sense for the risk carrier is often challenging. The mutual model in microinsurance that provides for returning back a part of the profits generated by the scheme to its insured population seems to be a good answer to this conundrum. Generally speaking products should be priced such that the 'risk premium' (or the loss ratio) is around 60% of the premium so that the product while offering good client value also takes care of adminsitration and acquisition costs. Moreover the microinsurance sector is also evolving some social performance indicators to ensure that the product as well as the programme generates good social value (www.microinsurancenetwork.org).

Mon, April 29, 2013 | Arman Oza

Originally published April 21, 2013