One of the highlights of the Arusha conference was the opportunity to meet delegates from close to 50 countries, with as many diverse reasons for promoting savings groups. While the methodology is designed as a financial tool, practitioners from across the globe were quick to point out the social benefits the groups bring. Each person I spoke to had a different observation of the ways in which savings groups are improving the lives of their members. The following is just a small sample of their responses.

Creating Social Networks for Immigrants in Barcelona

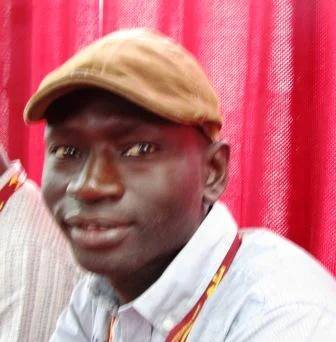

Abdoulaye Fall, ACAF Self Funded Communities

I started out as a member of a self-funded community group (savings group) when I moved from Senegal to Barcelona, Spain. For immigrants in a new city, savings groups enable them to connect to people from home and to build a new community. And the members of a group aren’t necessarily all from one country. One group of just 18 people has members from 8 countries, including Senegal, Gambia, Spain, Romania, Ecuador, and Ghana. When immigrants first arrive, they don’t know the country. The groups help them to find their way.

Increasing Participation of Mayan Women in Guatemala

Noelle Memus, Institutu de Ensenanza para el Desarolloo Sostenible

We started by forming groups of Mayan women in Baja Verapaz and Solola. It’s been a great experience. We’ve seen a recovery of values, of confidence and leadership. Many women are now participating in local government and are sitting on committees.

Improving the Status of the Disabled in Ghana

Diana Akuamoah Bactang, Ghana Society of the Physically Disabled

There is so much prejudice. People assume that because someone is disabled, they can’t do anything for themselves, but they can. The group members start with their own savings. They are learning, and they are saving more and more. After some time, they will begin lending and be recognized within their communities.

Building Peace in Sierra Leone

Abass Boh, Hands Empowering the Less Privileged

After the war, we needed a way to occupy people’s minds, so we decided to use savings groups to encourage small business growth. Peace is fragile, so the best way to create stability is to allow the youth to develop ambition. With their accumulated savings and access to loans, young members are rebuilding their lives, going back to school, and starting small businesses.