Savings Groups or MFI groups: Which give a better deal?

Chris Dunford, Senior Research Fellow at Freedom from Hunger, launched the Evidence Project blog to explore with other practitioners the evidence available on the benefits and costs of different kinds of microfinance for the poor. In his recent postings, he explored one of the most fundamental assumptions for justifying microfinance—that it reduces the costs of borrowing and saving for the poor.

He concluded that women who participate in microfinance programs (like those of Freedom from Hunger), on average, get a better deal (lower net cost of borrowing and saving) than they would get from the locally available alternatives:

- When providers serve women who have no access to other financial service besides that provided by unreliable family and friends.

- When providers offer credit and saving services at lower monetary cost than local moneylenders/moneyguards—especially true in the case of Savings Groups that lend from their own savings and return the interest revenue to the common pot of savings.

- When providers train and support their staff to be non-formal adult educators and use this skill to offer start-up training and ongoing facilitation of group dynamics that foster members’ mutual assistance and enjoyment. This effect is hypothesized to be independent of any education content other than the group formation and self-management. The effect is expected to be stronger in the case of groups supported by MFIs that provide regular, multi-year support by their frontline staff.

Savings Groups which are independent of external credit offer a better deal, on balance, than the groups supported by MFIs offering loans from external capital. Assuming Savings Groups and MFI groups are trained and initially supported by similarly trained and supported frontline staff, the independent Savings Groups are hypothesized to have lower net costs of borrowing and saving, despite the dependent credit groups receiving longer term support by frontline staff of MFIs.

Note that these cautious conclusions are not about impacts due to investment of loans or use of savings or due to education in health or business topics or other services provided through the groups. They are simply about the net costs of group membership and of borrowing and saving. Note too that a conclusion is not being made about Savings Groups being more cost-effective or sustainable as a business model for allocation of donor dollars for the benefit of the poor—the “business case.

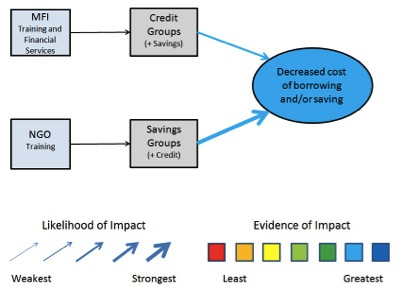

The diagram below summarizes the conclusion that both MFI-supported credit groups and, to a larger degree, NGO-supported Savings Groups give the poor access to borrowing and saving at substantially less cost than they would incur without these groups.

Follow and add your comments to the Evidence Project blog as Chris Dunford continues to build a benefits diagram based on the evidence available on the impacts of microfinance.

NB: Originally published July 2012 and re-dated to bring it further up the list. The Evidence Project was a discussion led by Chris Dunford, and it's a pleasure to read something that is thoughtful and reasonable and truth-seeking.